CFO GROUP INTEGRATED SERVICES

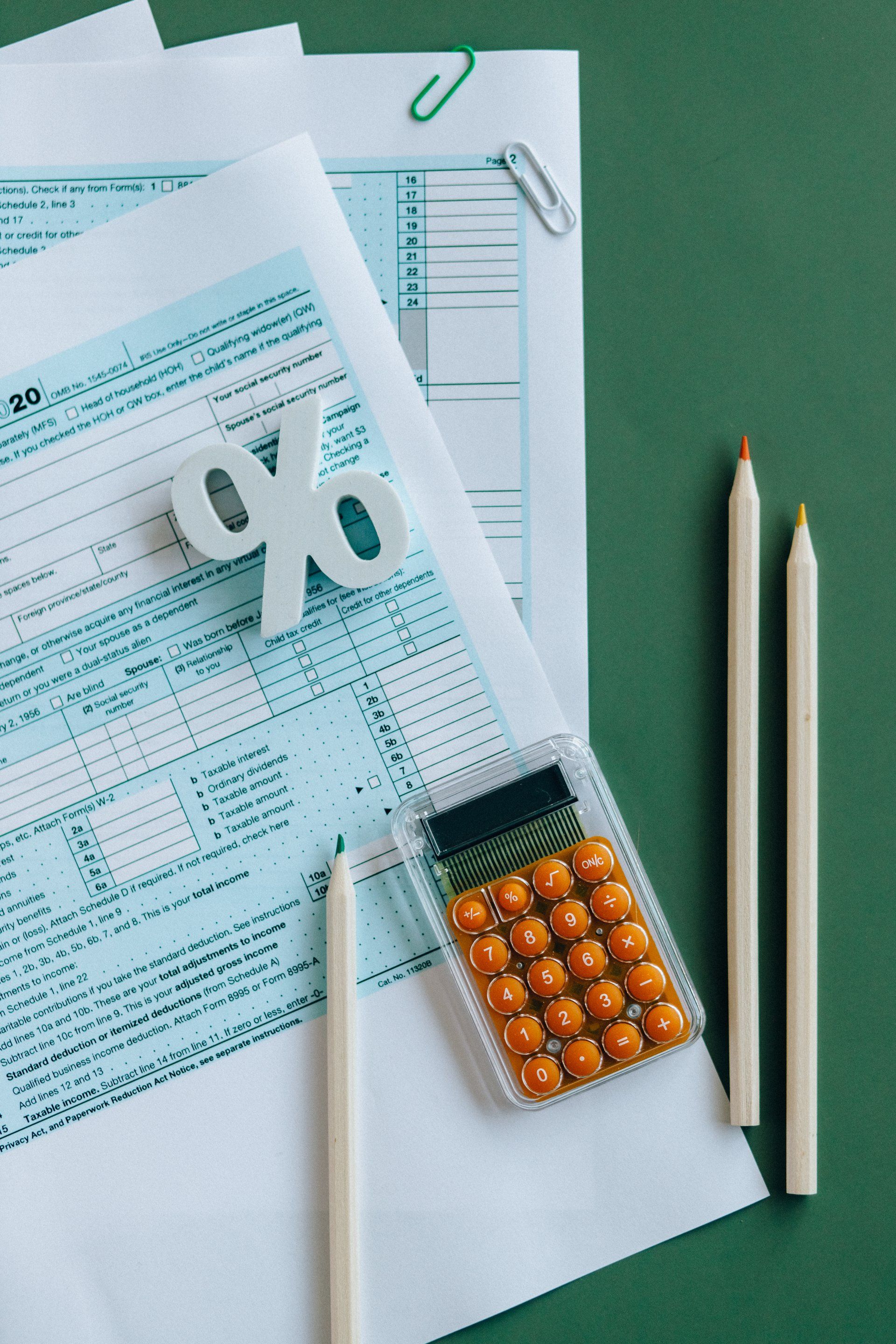

Accounting Services Singapore

Your Financial Beacon

Navigate the complexities of financial reporting with Singapore's premier full accounting services provider. We provide businesses, both local and international, with accurate financial insights, ensuring full compliance with Singapore's stringent regulatory standards.

Expertise

Certified professionals adept at Singapore's unique business environment.

Precision

Detailed and error-free financial reports to power your decision-making.

Compliance

Stay aligned with the latest regulatory changes and avoid penalties.

Ready to elevate your financial clarity? Let's collaborate and ensure your business thrives in Singapore's dynamic economic landscape.

Why Companies Need Accounting Services in Singapore?

Singapore stands as a global hub for commerce and trade, with its strategic location, robust economy, and favorable business policies. Within this dynamic ecosystem, maintaining transparent and precise accounting becomes paramount. Here's why:

Impeccable Financial Health

Proper accounting is the backbone of the balance sheet of any successful business. It offers a clear picture of your company's financial health, guiding crucial business decisions and fostering growth.

Navigating Regulatory Waters

Singapore boasts a stringent regulatory environment. Professional accounting firms ensure your business remains compliant, avoiding potential pitfalls and costly penalties.

Trust & Credibility

In the competitive Singapore market, having accurate financial records bolsters trust among stakeholders, clients, and partners.

Efficient Resource Management

With expert accounting, businesses can optimize cash flows, make cash flow, manage expenses, and allocate resources effectively.

CFO Accounts & Services: Your Business Accounting Solution

Nominee Director

Incorporate your business in Singapore seamlessly with our Nominee Director services. Safeguard your confidentiality while meeting statutory compliance obligations and bolstering credibility.

AGM and Filing of Annual Returns

Ensure punctuality and precision with our Annual General Meeting (AGM) and annual returns filing service. Stay compliant with Singapore’s regulatory mandates and sustain business integrity each financial year.

Corporate Tax Filing

Simplify tax complexities with our expert Corporate Tax Filing services. Stay abreast of evolving tax regulations in Singapore, ensuring timely submissions and optimal tax strategies.

Bookkeeping Service

Maintain a clear financial picture with our professional bookkeeping services. We offer timely, comprehensive income precise, and efficient financial record-keeping tailored to your business needs.

Company Incorporation

Kickstart your business journey in Singapore with our efficient company incorporation services. Benefit from a hassle-free registration process, ensuring compliance with local regulations and a smooth business onset.

Corporate Secretarial Services In Singapore

Our dedicated team facilitates a smooth and compliant process, ensuring your business meets all statutory obligations and operates with utmost efficiency. Trust CFO Accounts & Services to guide you through the complexities of corporate governance, so you can focus on your business's growth and success.

The Real Costs of Self-Managed Business Accounting

Missed Opportunities

Many small businesses overlook significant tax advantages due to a lack of knowledge or oversight. These benefits are designed to support and grow businesses like yours, and missing out on them means leaving money on the table.

Costly Mistakes

Financial errors, no matter how minor they seem, can lead to significant monetary discrepancies over time, affecting both a company's bottom line and its reputation. Beyond the tangible losses, the unseen costs include damaged trust with stakeholders and potential legal complications from overlooked financial regulations.

Stagnation

The rapid pace of today's business environment leaves no room for complacency. Without timely insights into market dynamics and financial trends, a business can easily find its offerings outdated. And if competitors are harnessing advanced financial strategies while you're not, they're gaining an edge, pushing you further behind.

Burnout

Managing finances without proper expertise can be both time-consuming and mentally taxing. This constant pressure doesn't only impact decision-makers' financial position; it can trickle down, affecting team morale and overall business productivity.

Benefits of Outsourced Accounting Services Singapore

Dedicated Team of Certified Professionals

Behind every successful business is a powerhouse of dedicated professionals. Our team, comprising certified experts, is committed to your success. With a meticulous approach, they ensure every financial detail is addressed, every question is answered, and every potential opportunity is explored. Their dedication means your peace of mind.

Sleep Easy, Knowing Your Finances Are in Safe Hands

Ever had that nagging feeling that you've missed out on a tax-saving opportunity? Or a worry that an unnoticed error is lurking in your books? With us on your side, those days are gone. Your financial compliance and accuracy are our top priority.

Allows Businesses to Focus on Core Operations

Outsourcing your business accounting functions grants you the luxury of time and focus. Rather than being mired in financial intricacies, you can direct your energies towards what truly matters: growing and innovating within your core business sectors.

Access to Expert Advice and Latest Financial Tools

With outsourced accounting firms in Singapore, you're not just hiring an external team, but also accessing a reservoir of financial expertise. This ensures that you benefit from the latest financial tools and technologies, as well as expert advice, positioning your business for optimal financial decision-making.

Assurance of Regulatory Compliance

Singapore's regulatory landscape is intricate. An outsourced and accounting firm and service ensures that all our clients remains on the right side of the law. By staying abreast of the latest regulations and requirements, these experts ensure your financial activities are always compliant, mitigating risks of penalties or infringements.

Cost-Effective Solutions

Maintaining an in-house accounting team can be a hefty expense, especially when factoring in recruitment, training, and overhead costs. Outsourcing offers a cost-effective alternative, where you get premium services at a fraction of the cost, translating to monthly revenue and enhanced profitability and financial efficiency.

Stay stress-free of ACRA's compliance changes

The Accounting and Corporate Regulatory Authority (ACRA) frequently updates its compliance mandates. By partnering with an outsourced accounting service, you're relieved from the constant vigilance these changes demand. Rest easy, knowing that professionals are monitoring and adapting to these shifts on your behalf, ensuring uninterrupted business operations.

📊 Master Your Finances with Precision!

Engage Our Expert Accounting Services and steer your business towards greater clarity and success!

Client Testimonials

Brandon J.

“Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi facilisis elit in quam aliquet, sed ultricies justo cursus. Cras finibus accumsan neque id lacinia. Sed ac odio magna. Suspendisse sem nulla, congue nec eros a, eleifend tempor quam. Proin non porttitor orci, non convallis nibh.”

Oliva R.

“ Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi facilisis elit in quam aliquet, sed ultricies justo cursus. Cras finibus accumsan neque id lacinia. Sed ac odio magna. Suspendisse sem nulla, congue nec eros a, eleifend tempor quam. Proin non porttitor orci, non convallis nibh. ”

Sheena K.

“Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi facilisis elit in quam aliquet, sed ultricies justo cursus. Cras finibus accumsan neque id lacinia. Sed ac odio magna. Suspendisse sem nulla, congue nec eros a, eleifend tempor quam. Proin non porttitor orci, non convallis nibh.”

Brandon J.

“Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi facilisis elit in quam aliquet, sed ultricies justo cursus. Cras finibus accumsan neque id lacinia. Sed ac odio magna. Suspendisse sem nulla, congue nec eros a, eleifend tempor quam. Proin non porttitor orci, non convallis nibh.”

Oliva R.

“ Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi facilisis elit in quam aliquet, sed ultricies justo cursus. Cras finibus accumsan neque id lacinia. Sed ac odio magna. Suspendisse sem nulla, congue nec eros a, eleifend tempor quam. Proin non porttitor orci, non convallis nibh. ”

FAQs on Accounting Services Singapore

-

How do we transition from our current accountant to CFO Account & Services?

Transitioning is a streamlined process. We begin with an initial consultation to understand your business's financial standing and current processes. Post this, we'll liaise with your existing accountant to transfer all necessary data, ensuring a seamless handover with minimal disruption to your operations.

-

How does your pricing work?

Our pricing is both competitive and transparent. Costs are determined based on the specific services you require, the complexity of your financial operations, and the volume of transactions. We offer bespoke packages tailored to individual and small business' needs, ensuring you get value for your investment.

-

Is outsourcing accounting services better than in-house?

Outsourcing accounting services can offer several advantages over in-house teams, such as access to specialized expertise, cost savings, and assurance of regulatory compliance. However, the best choice depends on the individual needs and preferences of your business. For many, especially SMEs, outsourcing provides a more flexible and cost-effective solution.

-

What are the top accounting software solutions?

While there are several accounting software solutions available, Xero stands out as a leading choice, especially in Singapore. As a Xero Platinum Partner, we are well-versed in its comprehensive features, real-time data access, and seamless integrations. Its user-friendly interface and robust capabilities make it the preferred solution for many businesses, ensuring streamlined accounting and financial operations.

-

Why is accurate bookkeeping important for businesses?

Accurate bookkeeping is crucial as it provides a clear picture of a business's financial health. It ensures that financial statements are precise, aiding in informed decision-making, compliance with regulatory standards, using management reports and building trust among stakeholders. Proper bookkeeping also streamlines tax filing processes and helps in identifying financial opportunities or challenges early on.

-

What are the accounting requirements in Singapore for businesses?

Singapore has a stringent regulatory landscape for businesses. Key requirements include maintaining proper accounting records, holding an Annual General Meeting (AGM), filing annual returns with ACRA, and adhering to the Singapore Financial Reporting Standards (SFRS). Additionally, depending on the business type and scale, there may be GST registration and filing obligations, corporate tax submissions, and other specific mandates.