CFO GROUP INTEGRATED SERVICES

What Is Outsourcing Payroll Services? 2025 Playbook, Step by Step

August 5, 2025

What is outsourcing payroll services? In simple terms, it means hiring an external payroll outsourcing company or payroll providers to handle critical payroll functions such as salary payments, tax deductions, tax reporting, and managing payroll records. Instead of relying on in-house payroll processing, businesses can shift routine payroll tasks to professional payroll service providers, reducing payroll errors, improving compliance, and saving time.

This article explains how payroll outsourcing services work, the different models available, the benefits of outsourcing payroll, and why outsourcing payroll is becoming essential for modern businesses.

Key Takeaways

- Payroll outsourcing helps businesses save time, reduce compliance risks, and achieve greater cost savings.

- Outsourcing payroll services enables accurate salary calculations, timely tax payments, and compliant payroll reporting.

- Payroll providers use advanced payroll software to ensure efficient payroll processing, minimize payroll errors, and maintain secure payroll data.

- The global payroll outsourcing market is growing rapidly, driven by the demand for secure, cloud-based payroll solutions and support for international employees.

Understanding Outsourcing Payroll and Payroll Providers

Outsourcing payroll means transferring payroll operations like processing payroll, withholding payments, and filing taxes to an external payroll outsourcing provider. A payroll company or payroll department outside your organization takes responsibility for payroll implementation, ensuring accurate salary payments and timely payments to employees.

For many businesses, outsourcing payroll services frees up internal staff from managing payroll in-house so they can focus on core business activities. It also provides:

- Accurate payroll management with fewer mistakes

- Better handling of employee data and employee benefits administration

- Access to payroll expertise and payroll professionals

- Stronger payroll compliance with complex tax regulations

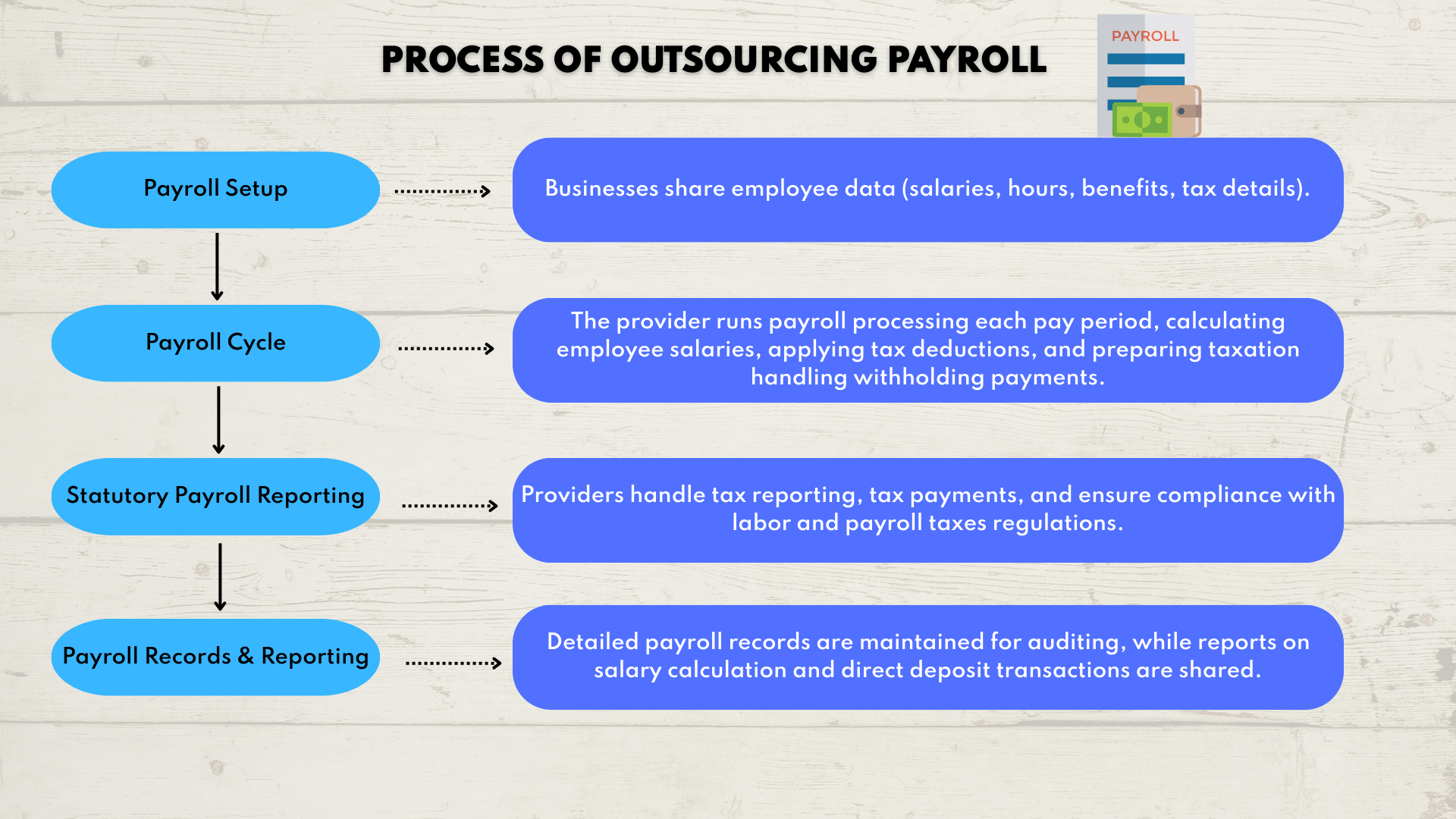

How Payroll Outsourcing Services and Payroll Processing Work

This structured approach ensures compliant payroll, supports accurate employee pay, and reduces the chance of payroll errors.

Types of Payroll Outsourcing Services and Payroll Systems

There are several payroll outsourcing service models to suit business needs:

| Model | Description | Best For |

|---|---|---|

| Professional Employer Organizations (PEOs) | Manage HR, payroll management, and employee payroll support, including employee benefits. | Small to mid-sized businesses seeking a bundled HR + payroll solution. |

| Certified PEOs (CPEOs) | U.S.-specific payroll providers certified by the IRS, offering stricter payroll compliance checks. | U.S.-based companies seeking robust compliance assurance and IRS recognition. |

| Administrative Services Organizations (ASOs) | Handle administrative payroll tasks such as processing payroll and reporting, without a co-employment structure. | Companies that want to keep HR in-house but outsource payroll services. |

| Industry-Specific Providers | Offer tailored payroll solutions for regulated sectors (e.g., healthcare, construction) with varying payroll frequency and compliance management needs. | Businesses in highly regulated industries need sector-specific payroll compliance. |

| Hybrid Models | Flexible setups that combine different payroll outsourcing services and payroll systems to meet unique business needs. | Growing companies or multinationals seeking customizable global payroll outsourcing solutions. |

For global payroll outsourcing, businesses may rely on an international payroll provider to manage multi-country payroll, preventing fragmented payroll data and reducing multi vendor management issues.

Key Benefits of Outsourcing Your Payroll

1. Time and Cost Savings

- Businesses avoid the expense of maintaining an in-house payroll department and costly payroll software.

- Outsourcing payroll increases efficiency by reducing hours spent on run payroll and correct payroll errors.

- Frees management from routine payroll operations so they can focus on core business activities.

2. Enhanced Payroll Compliance

- Providers stay updated on changing tax regulations and compliance management requirements.

- They reduce compliance risks tied to payroll taxes, tax reporting, and tax payments.

- Employers still hold legal responsibility, but a good payroll provider minimizes the chance of penalties.

3. Access to Payroll Expertise

- Payroll professionals handle complex payroll functions with precision.

- Businesses gain access to specialized knowledge in payroll implementation, employee benefits, and salary calculation.

- Outsourcing payroll services ensures efficient payroll processing by experienced teams.

Data Security in Payroll Outsourcing Services

One of the biggest concerns in payroll outsourcing work is data security. A reliable payroll outsourcing company will:

- Use encryption, multi-factor authentication, and secure file transfers to protect payroll data.

- Comply with privacy regulations governing employee data and payroll records.

- Conduct audits to ensure payroll system integrity and security.

This protects both sensitive employee payroll information and business reputation.

Challenges in Payroll Outsourcing

While outsourcing payroll is beneficial, challenges include:

- Risks of payroll data breaches if providers lack safeguards.

- Loss of visibility compared to in-house payroll processing.

- Potential issues with multi vendor management or fragmented payroll data in global payroll operations.

These risks highlight the importance of selecting trusted payroll partners with strong payroll expertise.

Global Payroll Outsourcing

The global payroll outsourcing market is expanding, with demand driven by businesses employing international employees.

Key challenges in global payroll outsourcing include:

- Adhering to different tax regulations and payroll frequency rules across countries

- Managing multi-country payroll without creating fragmented payroll data

- Avoiding compliance risks in different jurisdictions

A global payroll provider offers a centralized payroll solution, streamlining payroll operations while ensuring timely payments across regions.

The Future of Global Payroll and Payroll Software Trends

- Cloud payroll software is now standard for efficient payroll processing.

- Blockchain payroll solutions remain experimental but promise stronger data security.

- Growth of the gig economy and international employees increases demand for flexible payroll outsourcing services.

Steps for Successful Payroll Implementation with a Payroll System

- Time payroll outsourcing around year-end for smoother transition.

- Run parallel payroll cycles to test accuracy before making the switch entirely.

- Train HR staff on the new payroll system.

- Maintain clear communication with your payroll service providers and monitor reports for correct payroll errors.

Cost Savings and ROI of Outsourcing Payroll Services

Outsourcing payroll services reduces overhead linked to in-house payroll, including staff salaries, training, and payroll software expenses.

The ROI comes from:

- Lowering the cost of processing payroll

- Reducing payroll errors and compliance fines

- Freeing up leadership to focus on core business activities

Summary

Payroll outsourcing is more than just delegating payroll tasks — it’s about achieving efficient payroll processing, better payroll compliance, and significant cost savings.

Whether you are running a small business with local payroll outsourcing companies or managing global payroll outsourcing for international employees, partnering with the right payroll outsourcing providers ensures accurate payroll management, secure payroll data, and timely employee pay.

By outsourcing, businesses gain expert support, reduce errors, and enhance compliance — making outsourcing payroll services a strategic choice for long-term success.:

Payroll Outsourcing Services by CFO Group

CFO Group provides reliable payroll outsourcing services to help businesses streamline payroll processing, ensure payroll compliance, and eliminate costly payroll errors. Our team of experienced payroll providers manages everything from salary calculations, tax deductions, and direct deposits to secure payroll data handling and statutory payroll reporting. By outsourcing your payroll to CFO Group, you gain access to advanced payroll software and expert payroll professionals who guarantee accurate, timely, and compliant payroll every cycle — allowing you to focus on your core business activities with total peace of mind.