CFO GROUP INTEGRATED SERVICES

What Is a Bookkeeper Duties? 2025 Guide to Accurate Financial Records

CFO Group • July 22, 2025

Bookkeepers are the backbone of accurate financial records, ensuring every transaction is documented correctly. They handle recording financial transactions, managing accounts payable and accounts receivable, and using accounting software to maintain organized financial records. This article explores bookkeeper responsibilities in detail, outlining their duties and responsibilities and how they support a company’s financial health.

Key Takeaways

- Bookkeepers are essential for maintaining accurate financial records, including business’s daily financial transactions, bank reconciliation, and data entry.

- They prepare financial reports such as balance sheets, income statements, and profit and loss statements to provide insights into a company’s financial health.

- A skilled bookkeeper saves small business owners time, improves accurate bookkeeping, and supports tax compliance by organizing accounting records in a timely manner.

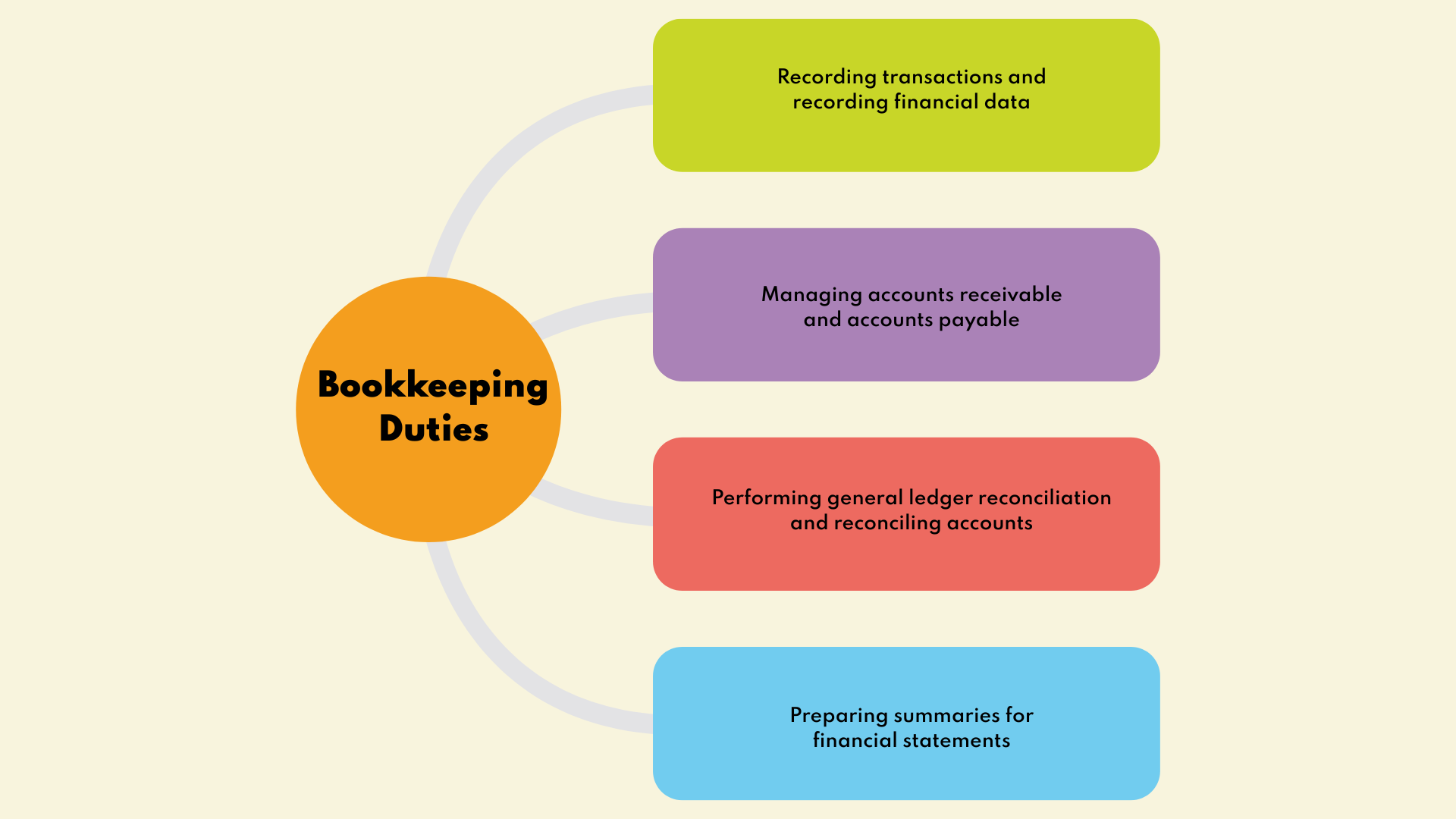

Core Bookkeeping Duties and Job Duties Explained

At the heart of every successful business is accurate record-keeping. Bookkeepers ensure tracking transactions in a timely manner, keeping the company’s financial records organized for the accounting department.

By using bookkeeping software and modern software systems, bookkeepers simplify financial management and improve business performance.

Recording Transactions and Data Entry with Accounting Software

Bookkeepers are responsible for tracking sales, purchases, and expenses. This data entry ensures that a business’s financial information reflects its true business’s finances.

Each transaction is recorded with details like date, amount, and parties involved. These accounting records provide a reliable foundation for tax preparation and strategic decision making.

Sole director rule: If the company has only one director, that person cannot simultaneously be the secretary.

Extra Qualifications (Public Companies)

For a public company, the Singapore company secretary must satisfy additional professional qualifications. Typical pathways include being a qualified person under the Legal Profession Act, a public accountant under the Accountants Act, or a member of recognised professional bodies (e.g., chartered secretaries, company accountants, certified public accountants, or international accountants). Directors must also be satisfied the appointee has requisite knowledge and extensive knowledge of company law, corporate governance, and the company’s administrative functions.

Managing Accounts Receivable, Accounts Payable, and How to Manage Invoices

| Account Type | Key Bookkeeping Duties |

|---|---|

| Accounts Receivable | • Monitoring customer invoices • Issuing reminders • Ensuring payments are received |

| Accounts Payable | • Bookkeepers manage invoices • Track due dates • Process supplier payments to avoid penalties |

This careful management supports small business owners in meeting obligations and improving business performance.

Bank Reconciliation: Ensuring Accurate Records

Bookkeepers compare bank statements with accounting records through account reconciliations. This process of bank reconciliation ensures:

- Errors are corrected

- Fraud is detected early

- The general ledger is accurate

Regular reconciling accounts gives business owners confidence in their company’s financial health.

Preparing Financial Reports and Monthly Statements

Bookkeepers help prepare financial statements such as:

- Balance sheet

- Income statements

- Cash flow statements

These monthly financial statements and financial reports provide snapshots of a company’s financial activities. While accountants perform deeper analysis, professional bookkeepers supply the foundation with accurate financial data.

Payroll Processing, Tax Compliance, and Bookkeeping Duties

Another important area of bookkeeper responsibilities is managing payroll. Tasks include:

- Payroll processing (calculating wages, hours, and benefits)

- Handling payroll taxes and tax deductions

- Preparing payroll records for tax filing

⚠️ Note: Bookkeepers support tax preparation, but certified public accountants or an accounting firm typically finalize tax returns to ensure compliance with regulations.

Advanced Bookkeeping Duties: Beyond Daily Job Duties

Today’s experienced bookkeeper may handle more advanced job duties such as:

- Assisting with year-end closing

- Supporting tax preparation and tax payments

- Helping multiple clients track business’s finances

- Organizing accounting records for legal compliance

Some bookkeepers even provide bookkeeping services that include advisory support, though the difference between a bookkeeper and an accountant is that accountants perform deeper analysis and file taxes.

The Importance of Accurate Records for Financial Reports

Accurate bookkeeping benefits small business owners by:

- Maintaining accurate records for tax returns

- Improving business performance with reliable financial information

- Supporting strategic decision-making with financial reports

Hiring professional bookkeepers ensures attention to detail in every aspect of financial management.

When to Hire Professional Bookkeeping Services

Businesses should consider bookkeeping services when:

- Financial activities grow too complex

- The volume of business’s daily financial transactions increases

- Business owners spend excessive time on recording financial transactions instead of growth

An experienced bookkeeper helps maintain accurate bookkeeping, saving owners time and reducing risks in a timely manner.

Choosing a Skilled Bookkeeper

When evaluating bookkeeper responsibilities, check for:

- Key skills like organization, attention to detail, and communication

- Credentials (in the U.S., certified public bookkeepers or those with a high school diploma plus experience; internationally, qualifications differ)

- Background working with small businesses or in an accounting firm

A reliable financial professional should make financial information easy to understand, especially for business owners juggling multiple clients and responsibilities.

Summary

In summary, bookkeeping duties include recording financial transactions, managing payroll, preparing financial statements, and ensuring accurate record-keeping for tax compliance.

While a bookkeeper and an accountant are not the same, professional bookkeepers provide the essential groundwork that accountants build on for tax returns and advanced planning.

Accurate bookkeeping services improve business performance, help business owners manage their business’s finances, and ensure legal compliance — making them an indispensable part of financial success.

Professional Bookkeeping Services with CFO Group

At CFO Group, we go beyond simple bookkeeping duties — we help small business owners maintain accurate financial records, manage accounts payable and accounts receivable, and prepare clear financial reports that reflect your company’s proper financial health. Our skilled bookkeepers combine modern accounting software with hands-on expertise, ensuring every transaction is recorded with precision and compliance in mind. Whether it’s data entry, bank reconciliation, or supporting tax preparation, CFO Group provides the reliability and efficiency you need so you can focus on growing your business with confidence.