CFO GROUP INTEGRATED SERVICES

Who Can Appoint Company Secretary: Latest 2025 Checklist & Steps

CFO Group • July 8, 2025

If you’re wondering who can appoint company secretary for a Singapore company, the answer under Singapore company law is clear: the board of directors. In practice, the company directors pass a board resolution (at board meetings or by written resolution, depending on your company constitution) to appoint a company secretary in a timely manner, and then update the corporate regulatory authority (the Accounting and Corporate Regulatory Authority, commonly shortened in industry to “accounting and corporate regulatory”) to keep company records compliant with the Companies Act/Singapore Companies Act.

Key Takeaways

- Authority to appoint: The board of directors appoints the company secretary/corporate secretary.

- Timing: Private companies must not let the position be vacant beyond the statutory limits; appointments and changes should be filed with the regulatory authorities in a timely manner to meet filing deadlines.

- Eligibility: The company secretary must be a natural person who is a Singapore resident (e.g., Singapore citizen, Singapore permanent resident, or certain valid pass holders with a local residential address, subject to pass conditions and any specific employment contract).

- Sole director rule: A sole director cannot also be the company’s sole secretary.

- Public company secretaries must meet extra professional qualifications (e.g., qualified person under the Legal Profession Act, public accountant under the Accountants Act, or membership in recognised bodies such as chartered secretaries, company accountants, certified public accountants, or international accountants).

- Role & scope:

- The secretary safeguards legal compliance, manages administrative and statutory duties, maintains statutory registers, and supports good corporate governance.

Who Has the Authority to Appoint?

Under the legal framework of the Companies Act, the company directors decide who can appoint company secretary—it is the board. The decision is documented in minutes of board meetings (or by written resolution) and retained with company records. Many companies use a registered filing agent (acting through a registered qualified individual) to submit officer changes to the regulatory authorities promptly.

Note on the company seal: The modern Act makes a company seal optional. If your company constitution still refers to sealing, follow that process; otherwise, execution can be done without a physical seal in accordance with the Act and your constitution.

Eligibility & Residency (Private Companies)

For private companies, the company secretary in Singapore/secretary in Singapore must be:

- A natural person (not a corporate body);

- Ordinarily resident in Singapore (often a Singapore citizen or Singapore permanent resident; certain holders of an Employment Pass or Dependent Pass may qualify if they genuinely reside here and their specific employment contract/pass conditions allow it);

- Available at a residential address/local residential address for official communications and able to discharge statutory obligations and other duties.

Sole director rule: If the company has only one director, that person cannot simultaneously be the secretary.

Extra Qualifications (Public Companies)

For a public company, the Singapore company secretary must satisfy additional professional qualifications. Typical pathways include being a qualified person under the Legal Profession Act, a public accountant under the Accountants Act, or a member of recognised professional bodies (e.g., chartered secretaries, company accountants, certified public accountants, or international accountants). Directors must also be satisfied the appointee has requisite knowledge and extensive knowledge of company law, corporate governance, and the company’s administrative functions.

Step-by-Step: How to Appoint a Company Secretary

- Check your constitution

Confirm how appointments are made (meeting vs. written resolution), and whether your constitution mentions a company seal. - Verify eligibility

Ensure the candidate is a natural person, a Singapore resident, and—if a public company—meets the professional qualifications. Where relevant, confirm pass conditions (Employment Pass, Dependent Pass) and any specific employment contract restrictions. - Consent & onboarding

Obtain written consent from the appointee, capture particulars (full name, residential address, ID/pass details), and orient new directors and company officers on how they will work with the secretary. - Board approval

Pass a board resolution to appoint a company secretary, stating the effective date and noting the statutory duties the role will perform. - File with the authority

Use your internal officer or a corporate secretarial firm/corporate secretarial services/registered filing agent to lodge the change with the corporate regulatory authority in a timely manner. - Update internal records

Enter the secretary’s particulars in the company’s registers/statutory registers, prepare/update legal documents (e.g., standing resolutions), and align internal filing deadlines (e.g., annual returns, director/secretary changes, company name changes, company shares allotments).

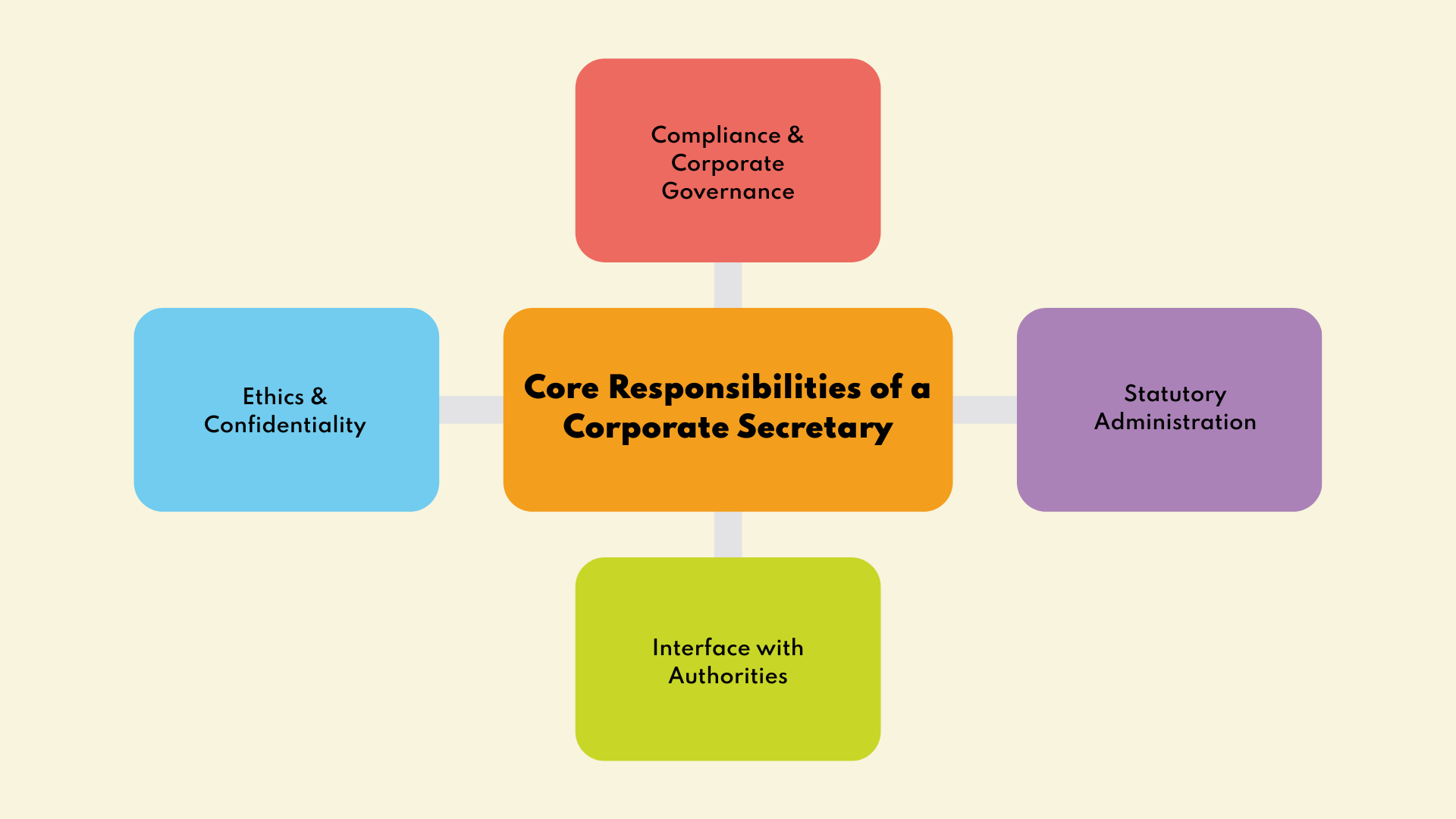

Core Responsibilities of a Corporate Secretary

A Singapore company secretary is central to the responsibilities of a company around compliance and governance:

1. Compliance & Corporate Governance

- Ensuring legal compliance with the Companies Act (and what the Companies Act states) and related rules;

- Protecting good corporate governance practices;

- Advising the company directors and company officers on company law and procedure.

2. Statutory Administration

- Maintaining statutory registers (members, officers, charges, if applicable) and company records;

- Preparing notices, agendas, and minutes for board meetings, AGMs, and EGMs;

- Filing Annual Returns and change notifications by filing deadlines;

- Keeping legal documents organised (e.g., resolutions, share allotments, financial reports, appointments/cessations).

3. Interface with Authorities

- Submitting updates to regulatory authorities in a timely manner, often via a registered filing agent/registered qualified individual;

- Coordinating with auditors, company accountants, and public accountant where needed.

4. Ethics & Confidentiality

- Upholding fiduciary standards—no secret profit, no misuse of position;

- Protecting trade secrets and not revealing confidential information without authority.

While you can outsource to a corporate secretarial firm to provide practical support/practical support, ultimate responsibility remains with the company directors.

Replacing or Removing the Secretary

- Obtain a resignation letter from the outgoing secretary (or pass a removal resolution).

- Appoint the new secretary by board resolution and file the change with the regulatory authorities.

- Keep the position from being vacant beyond the statutory window; plan transitions to avoid gaps in statutory obligations.

Special Notes & Common Scenarios

- Private companies vs public companies: Private companies have the baseline rules above; public companies must appoint a secretary meeting enhanced professional qualifications and with demonstrable extensive knowledge of complex compliance.

- Branches of foreign companies: A Singapore branch of a foreign company is governed by different provisions (authorised representatives rather than a “company secretary” in the strict sense).

- Changes in structure: If you change company name or issue company shares, your secretary coordinates board/shareholder actions, updates company’s registers, and files required forms.

- Documents & seals: Where your constitution requires it, certain documents may still reference a company seal; otherwise, modern execution methods apply.

Why Engage Corporate Secretarial Services?

A good corporate secretarial firm can reduce risk and workload by handling routine filings, annual returns, meeting admin, and updates to statutory registers. They coordinate with company accountants, auditors, and your public accountant, and ensure the business stays inside the legal framework with legal compliance and good corporate governance—freeing leadership to focus on growth.

Frequently Asked Questions (FAQ)

Who appoints the company secretary?

The board of directors. They pass a resolution and then ensure the change is filed with the corporate regulatory authority.

Can a director be the secretary?

If there is only one director, that sole director cannot also be the secretary. If there are multiple directors, one of them may serve as secretary (subject to eligibility and workload).

What does “ordinarily resident” mean?

Typically a Singapore citizen or Singapore permanent resident. Certain holders of an Employment Pass or Dependent Pass may qualify if they genuinely reside here and their specific employment contract allows it, but always check pass conditions.

What extra rules apply to public companies?

A public company must appoint a secretary who meets enhanced criteria, such as being a qualified person under the Legal Profession Act, a public accountant under the Accountants Act, or a member of recognised chartered secretaries, company accountants, certified public accountants, or international accountants bodies.

What exactly does the secretary do?

They run the company’s compliance engine: administrative and statutory duties, maintaining company records, company’s registers, ensuring legal compliance, preparing minutes, and filing annual returns and other updates by filing deadlines.

Can we outsource the role?

Yes. Many companies appoint an in-house officer but rely on corporate secretarial services/corporate secretarial firm/registered filing agent support to manage filings and documents.

What about confidentiality and ethics?

The secretary must not make secret profit, must not reveal confidential information, and must safeguard trade secrets. Integrity is part of good corporate governance.

Quick Compliance Checklist

| ✔ | Compliance Checklist |

|---|---|

| ☐ | Board resolution passed to appoint a company secretary |

| ☐ | Secretary is a natural person and a Singapore resident with a local residential address |

| ☐ | Sole director is not the secretary (if applicable) |

| ☐ | For public company, secretary meets professional qualifications (e.g., qualified person, public accountant, chartered secretaries, certified public accountants, international accountants) |

| ☐ | Details lodged with regulatory authorities via internal staff or registered filing agent/registered qualified individual in a timely manner |

| ☐ | Statutory registers and company records updated; filing annual returns/annual returns calendar in place |

| ☐ | Clear policy on confidentiality, no secret profit, and safeguarding trade secrets |

| ☐ | Secretary empowered to prepare and sign legal documents and coordinate financial reports where appropriate |

| ☐ | Orientation in place for new directors and company officers |

Final Word

Choosing and appointing the right Singapore company secretary is more than a checkbox. It’s a structural pillar of corporate governance, ensuring the responsibilities of a company are met—accurate records, punctual filings, compliant meetings, and trustworthy handling of confidential matters. Whether you appoint in-house or work with a corporate secretarial firm, make sure your secretary has the requisite knowledge and systems to keep your business aligned with the Companies Act and best practice—today and as you grow.

Looking for Hassle-Free Corporate Secretary Support?

CFO Group provides end-to-end corporate secretarial services in Singapore—appointing a resident company secretary, maintaining statutory registers, preparing board/AGM minutes and resolutions, and filing changes and annual returns via BizFile+ to keep you compliant with the Companies Act and ACRA. Whether you’re a new private limited or a growing public company, our registered filing agents and chartered professionals handle officer updates, share allotments, constitution changes, and routine governance so you stay organised, on time, and audit-ready—seamlessly integrated with our accounting and tax support for one accountable partner.